Summary: During the 13 August 2024 Council Meeting, the City proposed a “small tax rate increase” of .0349¢ because of the increases in both M&O (maintenance and operation) and I&S (debt payments). Willow Park Citizens are encouraged attend and speak during the next two Council meetings, 27 August and 10 September.

Latest update: 19 August 2024

Select #Tags for additional articles: #Finance #PropertyTax

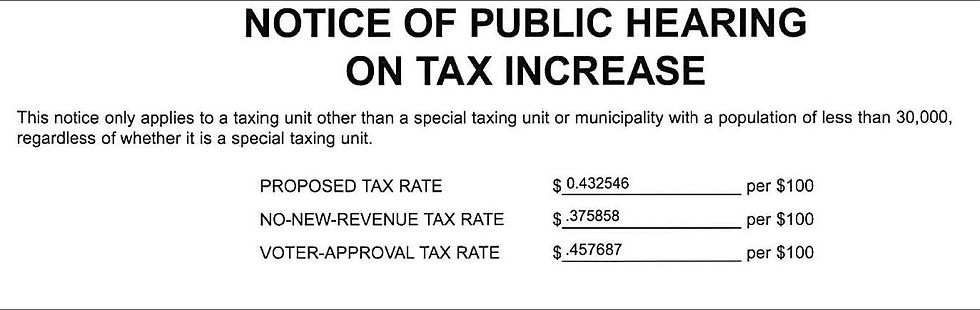

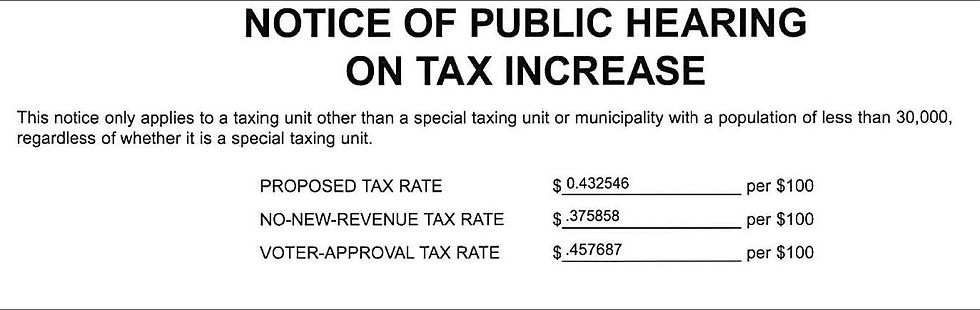

Willow Park is planning to increase the property tax rate for 2024 - 2025.

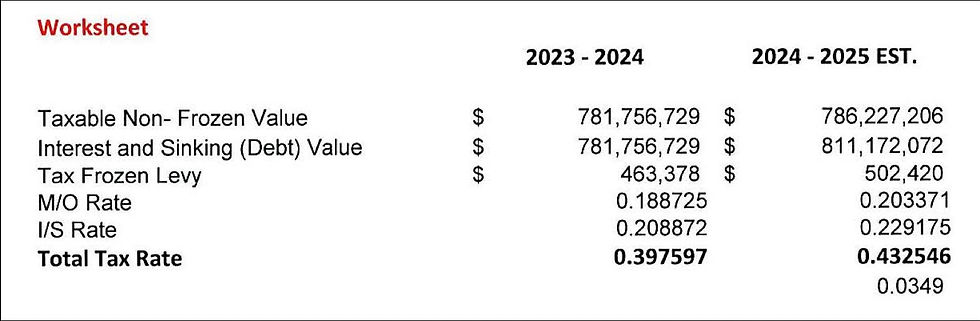

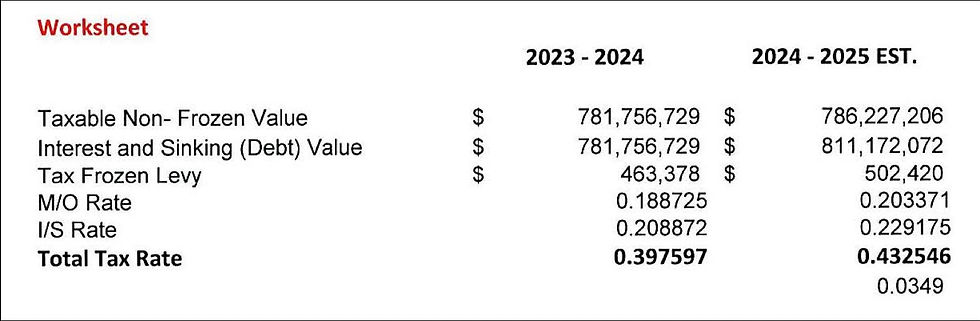

During the 13 August 2024 Council Meeting, [1, Video] the City proposed a “small tax rate increase” of .0349¢ because of the increase in both M&O (maintenance and operation) and I&S (debt payments). [2]

Additionally, City Administrator Grimes indicated the following:

• Parker County Appraisal District, CAD, tax values were “somewhat flat.”

• There was a discussion of the City's "debt cliff."

• "Two years from now, when we set the debt rate it will drop off about $600K in debt service."

• There was also conversation about using the $600K "debt cliff" savings to begin the Squaw Creek Road improvements.

• During next meeting [27 August 2024 Council Meeting] the Council will vote on this proposed tax rate increase.

• Then, the City will have The Community News, the Willow Park newspaper of record, post an ad for the new tax rate.

• During the 10 September 2024 Council meeting, the Council will adopt the 2024-2025 budget and 2024-2025 tax rate.

Willow Park Citizens are encouraged attend and speak during the next two Council meetings, 27 August and 10 September. Voice your opinions now; your next chance will be May 2025, during the next municipal election.

Sources and Resources

[1] 13 August 2024 Council Meeting, Agenda Item #7. Discussion Only: Tax Rate and Budget Workshop for the FY 24-25. #Finance

• Background: This is the 2nd Budget Workshop of this fiscal year. Staff trued up some line items such as insurance costs, lease costs, etc. Included in this discussion is the proposed tax rate for Council consideration at a future meeting, presumably August 27. Included in the discussion:

• 2024 Tax Rate Calculation Worksheet from the CAD [Parker County Appraisal District]

• Staff Tax Rate Worksheet

• City Debt Spreadsheet (All Funds)

• Meeting Youtube Video 32:27

[2] Willow Park Civics > Resources > Glossary Plus

• Overview of Local Taxes in Texas, Prepared for the Senate Committee on Finance November 2002

• The annual property tax levy in any jurisdiction is derived by multiplying the total taxable value in the jurisdiction by the total tax rate. The total tax rate may include a rate for debt service payments—often called the “I&S rate” or interest and sinking fund rate—and a rate for day-to-day maintenance and operations—the “M&O rate.”

• Maintenance and operations (M&O) tax: An M&O tax is a property tax levied by a taxing unit to raise revenue for annual operating needs (Part of the Property Tax Rate.)

• Interest and sinking fund (I&S) tax: An I&S tax is a property tax levied to raise revenue to pay principal and interest on debt. (Part of the Property Tax Rate.)

• Comptroller of Texas > Taxes

• Willow Park Civics Blogs

•"Taxes of Texas, Field Guide" from TX Comptroller, Willow Park Civics Blog, posted 22 March 2024

Summary: “A fine is a tax for doing wrong. A tax is a fine for doing well.” Mark Twain. Find out how our public servants and politicians are spending our hard work.

• Willow Park Property Tax for 2023 and the Devil in the Details, Willow Park Civics Blog, posted 27 August 2023

Summary: While the City is celebrating its proposed real estate property tax rate decrease of $.14, don't get out your party hats, quite yet. The citizens of Willow Park will have a new, additional tax of $.10 levied by the Emergency Service District 1. And there's more buzzkill.

• Video about WP budget and tax rate, Willow Park Civics Blog, posted 24 September 2022

The Willow Park City Council approved the budget and tax rate for Fiscal Year 2022-23 at the Sept 13 City Council meeting. And they made a video to explain the basics.

Comments