Summary: During the 10 September 2024 Council Meeting, Willow Park Citizens are encouraged to speak and guide our elected officials, who have approved a property tax rate increase of $.0349, for a proposed property tax of $.432546 per $100 property value. In addition, there wii also be a Public Hearing on the City's 2024/2025 budget.

Latest update: updated 13 September 2024; posted 30 August 2024

Select #Tags for additional articles: #Finance #PropertyTax

• Note: Willow Park Civics is about Willow Park but is NOT associated with or managed by the City of Willow Park.

Public Hearing on 2024/2025 Budget and City Property Tax increase. Now is the time for Citizens to lead.

Updated:

• 10 September 2024 Council Meeting Review by The Community News, 13 September 2024, Willow Park Civics Blog, 13 September 2024

Willow Park City Council Meeting reviewed by the City of Willow Park newspaper of record, The Community News. Topics: • Taxes raised slightly to help police department [Review of City Budget] • Sign permit [for Canvas at Willow Park].

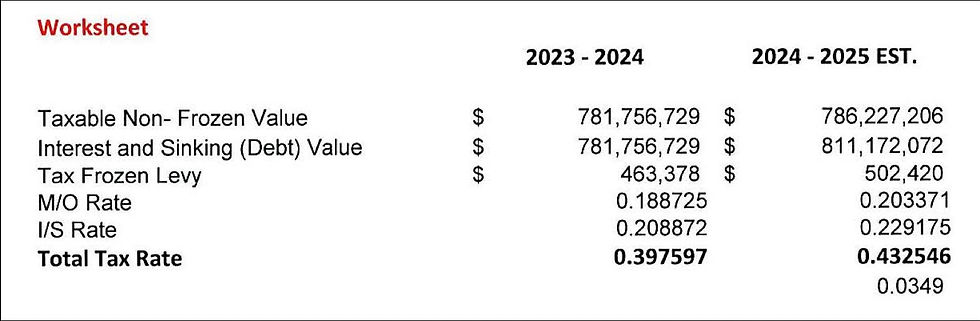

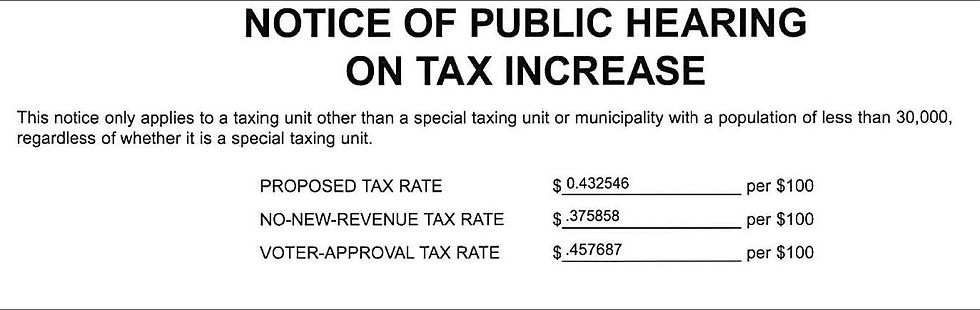

During the 27 August 2024 Council Meeting [1, 2], the City approved a property tax rate increase of $.0349, for a proposed .432546 cents per $100 property value, for the 2024/2025 property tax rate. [3, 4] The proposed new tax will bring in an additional $199,000, increasing the overall property tax income to around $1.8 million. [4]

Willow Park Citizens are encouraged to speak and guide our elected officials, during a Public Hearing during 10 September 2024 Council Meeting. [4]

The details of the property tax increase were posted in a Public Notice, published in the 30 August 2024 The Community News [4]

In addition, there wili also be a Public Hearing on the City's 2024/2025 budget, City of Willow Park Preliminary Budget, July 23, 2024 in .pdf

Willow Park Civics Sources and Resources

[1] 27 August 2024 Council Meeting, Agenda Item

• 2. Discussion /Action: to discuss, consider and act on approving a proposed ad valorem tax rate for the period beginning October 1, 2024 thru September 30, 2025. #PropertyTax #Finance

• Background:

State statute requires that Council take a roll call vote on the proposed tax rate for the upcoming budget for FY 23 - 24. This is part of the rate setting process.

As we have discussed at previous workshops the tax rate for your consideration is as follows:

For your review, please find the tax rate calculations from the Parker County Appraisal District and the staff worksheet that has been previously discussed.

• Exhibit: • 2024 Tax RateCalculation Worksheet

• 3. Discussion/Action: to discuss, consider, and act on to setting the date, time, and place for a public hearing on the tax rate and proposed budget for the period beginning October 1, 2024 thru September 30, 2025.

[2] Willow Park is planning to increase the property tax rate for 2024 - 2025. Willow Park Civics Blog, posted 19 August, 2024

During the 13 August 2024 Council Meeting, the City proposed a “small tax rate increase” of .0349¢ because of the increases in both M&O (maintenance and operation) and I&S (debt payments). Willow Park Citizens are encouraged attend and speak during the next two Council meetings, 27 August and 10 September. Details in linked blog.

[3] 27 August 2024 Council Meeting Review by The Community News, 30 August 2024, Willow Park Civics Blog, posted 30 August 2024, Excerpts.

Willow Park City Council members discussed a proposed 43 cents per $100 2024-25 property tax rate at their meeting on Tuesday, Aug. 27

The proposed rate is an increase from the 40 cents of the previous year, which came on the heels of a 14 cent tax reduction in 2023.

“I still think overall we’re one of the lowest tax rates in Parker County and the area,” Willow Park City Manager Bryan Grimes said.

Grimes also noted that the largest part of a tax increase would go to funding officer salary increases and purchasing equipment for the Willow Park Police Department. He said in the proposed new budget, the police department’s portion is between $2.1 and $2.3 million, adding the proposed new tax would bring in an additional $199,000, increase the overall property tax income to around $1.8 million.

Sales tax revenue covers the rest of the police department increase. However, because of inflation, sales tax revenue is down slightly from previous years, thus creating the need for the property tax increase.

“We take back the blue very seriously here,” Grimes said.

The new tax rate goes into effect on Oct. 1 and runs through Sept. 30, 2025, as would the Fiscal Year 2025 budget. The council is still working on finalizing the budget.

Both the tax rate and the budget are pending a public hearing, which will be held at the Sept. 10 meeting. The council is expected to vote on both that same night.

[4] Willow Park Public Notices for week ending Friday, 30 August 2024, Willow Park Civics Blog, posted 30 August 2024

• 13 August 2024 Council Meeting, Agenda Item #7. Discussion Only: Tax Rate and Budget Workshop for the FY 24-25. #Finance

• Background: This is the 2nd Budget Workshop of this fiscal year. Staff trued up some line items such as insurance costs, lease costs, etc. Included in this discussion is the proposed tax rate for Council consideration at a future meeting, presumably August 27. Included in the discussion:

• 2024 Tax Rate Calculation Worksheet from the CAD [Parker County Appraisal District]

• Staff Tax Rate Worksheet

• City Debt Spreadsheet (All Funds)

• Meeting Youtube Video 32:27

• 23 July 2024 Council Meeting, Agenda Item 7. Discussion Only: Budget Workshop for the FY 24-25 Budget.

• Minutes City Manager, Bryan Grimes did the presentation of the proposed budget. He will be filing the preliminary FY 24-25 Budget with the City Secretary. July 25th is the deadline for the Certified Appraisal Tax Roll to be provided to the city. At the August 27th city council meeting, City Council will discuss the tax rate, vote on proposed tax rate and set the public hearing for the budget and tax rate for September 10th.

• Willow Park Civics > Resources > Glossary Plus

• Overview of Local Taxes in Texas, Prepared for the Senate Committee on Finance November 2002

• The annual property tax levy in any jurisdiction is derived by multiplying the total taxable value in the jurisdiction by the total tax rate. The total tax rate may include a rate for debt service payments—often called the “I&S rate” or interest and sinking fund rate—and a rate for day-to-day maintenance and operations—the “M&O rate.”

• Maintenance and operations (M&O) tax: An M&O tax is a property tax levied by a taxing unit to raise revenue for annual operating needs (Part of the Property Tax Rate.)

• Interest and sinking fund (I&S) tax: An I&S tax is a property tax levied to raise revenue to pay principal and interest on debt. (Part of the Property Tax Rate.)

• Comptroller of Texas > Taxes

• Willow Park Civics Blogs

•"Taxes of Texas, Field Guide" from TX Comptroller, Willow Park Civics Blog, posted 22 March 2024

Summary: “A fine is a tax for doing wrong. A tax is a fine for doing well.” Mark Twain. Find out how our public servants and politicians are spending our hard work.

• Willow Park Property Tax for 2023 and the Devil in the Details, Willow Park Civics Blog, posted 27 August 2023

Summary: While the City is celebrating its proposed real estate property tax rate decrease of $.14, don't get out your party hats, quite yet. The citizens of Willow Park will have a new, additional tax of $.10 levied by the Emergency Service District 1. And there's more buzzkill.

• Video about WP budget and tax rate, Willow Park Civics Blog, posted 24 September 2022

The Willow Park City Council approved the budget and tax rate for Fiscal Year 2022-23 at the Sept 13 City Council meeting. And they made a video to explain the basics.

Comments