ERCOT Announces ‘New Era of Planning’ to Cope with Electricity Demand as 2030 Estimate Grows

- Manager

- May 10, 2024

- 5 min read

Updated: Jun 2, 2024

Summary: The new report estimates 40,000 MW more load online by 2030 than last year's projection. The load growth is driven by population and economic growth, particularly in the form of crypto mining and data centers. The ERCOT grid is in the midst of a struggle between rising electricity demand and the stagnation of its dispatchable generation.

Latest Update: 06 May, 2024

Select #Tags for additional articles: #Electricity

Article: ERCOT Announces ‘New Era of Planning’ to Cope with Electricity Demand as 2030 Estimate Grows

"Push is coming to shove on the tension between Texas’ massive economic growth and its main power grid, whose operator has announced a new planning strategy to cope with the rising demand.

"The new report estimates 40,000 MW more load online by 2030 than last year's projection. The load growth is driven by population and economic growth, particularly in the form of crypto mining and data centers.

"The ERCOT grid is in the midst of a struggle between rising electricity demand and the stagnation of its dispatchable generation footprint"

ERCOT Announces ‘New Era of Planning’ to Cope with Electricity Demand as 2030 Estimate Grows, The Texan, 23 April 2023, Excerpts

The new report estimates 40,000 MW more load online by 2030 than last year's projection.

Push is coming to shove on the tension between Texas’ massive economic growth and its main power grid, whose operator has announced a new planning strategy to cope with the rising demand.

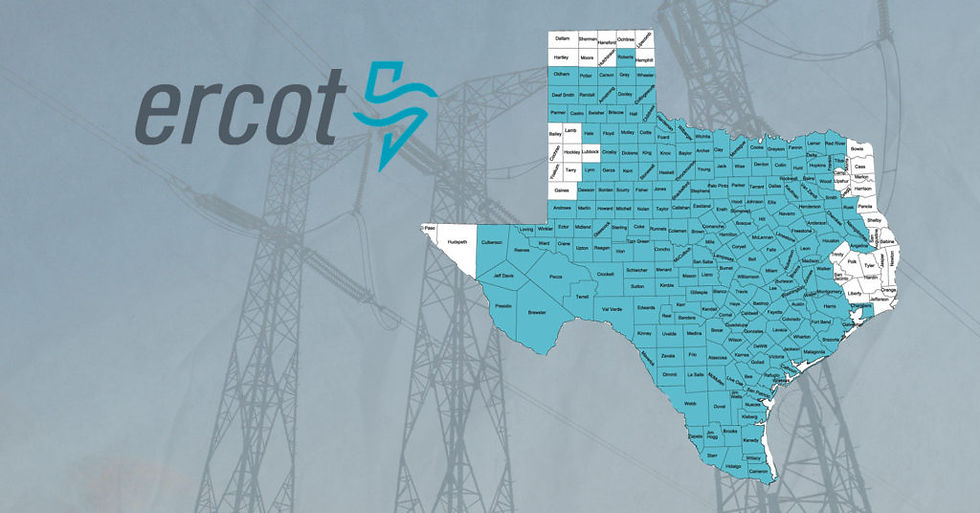

The Electric Reliability Council of Texas’ (ERCOT) new estimate for electricity demand in 2030 is 40,000 megawatts (MW) higher than its 2030 estimate from last year. One MW can power around 200 homes during peak demand.

“As a result of Texas’ continued strong economic growth, new load is being added to the ERCOT system faster and in greater amounts than ever before,” said ERCOT President and CEO Pablo Vegas following a Tuesday board meeting.

Summer peak demand — usually occurring during hot afternoons and typically the tightest part of the year in power grid terms — is expected to grow between 8,000 and 9,000 MW by 2032. The current all-time peak demand record was set in August last year at 85,464 MW.

The load growth is driven by population and economic growth, particularly in the form of crypto mining and data centers — both of which use massive computing power around the clock to provide their services.

ERCOT already has tools available designed specifically for these large load facilities, including demand response that provides these users financial incentives to shutter operations during periods of high stress, allowing the electricity flow to focus more on residential customers. There’s a growing call for a residential demand response product, though practically it is easier to conduct that program for a few hundred large users compared to millions of homes across the state — but it’s not impossible.

The ERCOT grid is in the midst of a struggle between rising electricity demand and the stagnation of its dispatchable generation footprint; “dispatchable” includes any generator that can be brought online on-demand, excluding wind and solar that depend on weather conditions to produce. Dispatchable can include battery storage, which has its own natural limitations but pairs well with the intermittent sources.

There are 1,775 requests for interconnection from new generators hoping to come online and provide service to the ERCOT grid — totaling 346,000 MW.

By source, the breakdown is:

155,000 MW of solar

141,000 MW of battery storage

35,000 MW of wind

15,000 MW of natural gas

For years, the ERCOT grid has hemorrhaged thermal generation while seeing a massive influx of renewables — a dynamic sparked chiefly by the federal government’s Production Tax Credit that pays wind and solar generators a credit for every kilowatt-hour produced. It gives that class of generators a large financial advantage, particularly in the ERCOT market that is so heavily dependent on organic price signals.

The Texas Legislature spent much of the 2023 session grappling with just how to reverse that course, providing a counterbalance to the federal credit through a few avenues: a loan program for the construction of new natural gas plants, the Performance Credit Mechanism designed to reward generators who produce during stressful periods, and a new market for break-in-case-of-emergency generators.

The other difficulty ERCOT faces is the lengthy transmission build-out time. Per the Thursday presentation, transmission timelines run from three to five years compared with the six to 12-month time for new load and generation.

“A new era of transmission system planning is necessary to manage the large amount of prospective load submitted by the Transmission Service Providers,” reads the presentation. Much of the transmission focus will be in the Permian Basin, as large load growth there is expected to reach 24,000 MW.

During a conference last October, Vegas stressed regarding the grid’s challenges, “There’s rarely ever a silver bullet.” That’s as true for a power grid as anything else. But getting out in front of it is the name of the game.

• All of the Above, Dr. M. Ray Perryman, 01 May 2024, Excerpts

The dynamic Texas economy and its growing population (and hot summers) require increases in electric generation and transmission capacity well beyond what was expected even a few years ago. Basic patterns of business expansion have been in place for decades. However, there are profound and unanticipated changes underway which are shifting power demand growth into an entirely new gear.

There has recently been a surge in electricity-intensive industries. Data centers supporting remote work, streaming, and now AI need massive megawatts to operate. Crypto mining is another major user. Electrification of cars and other machines further increases demand. Emerging industries, such as Tesla's gigafactory and LNG facilities across the Gulf Coast, also need a lot. Developments on the horizon to deal with climate issues, such as hydrogen production and carbon capture, will require enormous resources.

The Electric Reliability Council of Texas (ERCOT) manages the flow of power to more than 26 million Texas customers (about 90% of the total state load) and is fully aware of what's coming. During the past legislative session, changes were implemented enabling ERCOT to consider additions to grid requirements that are known to be coming. Previously, until new customers were added, the related increase in power needs couldn't be counted.

New planning documents project an additional 40 gigawatts (GW) of load growth by 2030 compared to the prior year's forecast. For context, ERCOT's all-time peak demand was just over 85 GW on a broiling day in August 2023. The impetus for this staggering upward movement is significant increases in large loads being considered (crypto mining, hydrogen and hydrogen-related manufacturing, data centers supporting AI, and greater electrification).

Obviously, Texas will need both generation and transmission capacity - and fast! Currently, ERCOT has 1,775 active generation interconnection requests totaling 346 GW planned for the next few years, including 155 GW of solar, 35 GW of wind, 15 GW of gas, and 141 GW facilitated by battery capacity. Benefits of this diversity of sources are that they can be built faster and with more location options. However, given that 190 GW is dependent on wind or sun, the batteries (as well as additional gas-fired capacity) will be crucial in the dog days of summer. It will necessitate an "all of the above" approach, and policy should accommodate all types of power resources.

It typically takes 3-5 years to plan, permit, and build transmission lines in Texas, which is about half the time needed in many areas (but challenging nonetheless). With current expectations, these projects must receive priority status.

Comentários